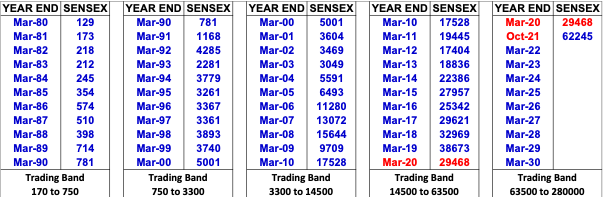

In Oct’21 Sensex crossed the 60000 mark. I’d talked about this possibility in a 2016 blog that highlighted how our nominal GDP had been growing at 14-15% for the previous 3 and 1/2 decades and the Sensex at 16% CAGR since its base year – 1979. That meant that every decade the Sensex, with all the volatility in the short term, grew 4.4 times in the band it traded at (see the table below)! Given that analysis it’s highly likely that the Sensex will cross 200000 this decade.

Does that sound too fanciful? Even at 60000 many investors believe that markets have become expensive. Not really, I believe that the markets are just back on track with the long-term trajectory of the fast-growing Indian economy! Even if they follow realistic 14% nominal GDP growth rates, sometime in the next 4-5 years the Sensex should cross the 100000 mark and the 200000 mark before 2030!

Does that sound too fanciful? Even at 60000 many investors believe that markets have become expensive. Not really, I believe that the markets are just back on track with the long-term trajectory of the fast-growing Indian economy! Even if they follow realistic 14% nominal GDP growth rates, sometime in the next 4-5 years the Sensex should cross the 100000 mark and the 200000 mark before 2030!

Pent up demand is powering up economy as the covid crisis settles

In 2020, the Covid crisis caused widespread disruptions in economic growth and the markets at the fag-end of the decade. In the first few months of the outbreak, the economy was hit from both sides – demand postponement as well as supply constraints. The markets saw deep, panic-induced cuts before they could stabilize again. Today, after 18 months have passed, there is finally some reasons to cheer. Pent-up demand in the economy has been converting rather quickly into sales numbers across industries, resulting into increased profit figures of most companies. After seeing negative GDP growth figures and free-falling markets in the last 18 months, in October, both GDP and market capitalization of listed stocks reached all time high levels of $3 Trillion each, with expectation of further improvement. With the long-term India growth potential intact, I believe that the markets will remain aligned to the same growth displayed in the last few decades before the pandemic.

India opportunity remains intact

I would like to remember India’s decade of 2010-20 as an era of consolidation and of gearing up to make economic growth more sustainable for the coming decades. For example, the implementation of the Insolvency and Bankruptcy Code in 2016 has today strengthened our banking system immensely. Out from the deep NPA problems, our banks are now geared up to provide the funds vital for future corporate growth.

Similarly, the make-in-India mission with the vision to be self-reliant are already showing results:

Almost all the Televisions sold in India today are made in India

We are today the second largest manufacturers of mobile phone handsets in the world (up from 12th position in 2014)

We are the 2nd largest steel manufacturer and the 3rd largest electricity generator.

We are making huge strides in defense manufacturing to reduce expensive imports in future.

We have a target to meet 50% of our energy requirements from renewable energy by 2030 and have made strong commitments towards using non-fossil fuel and reduction of carbon emissions

Commit to equity investing and reap the benefits

It is time to shake off the Covid concerns and start looking ahead and re-aligning our long-term goals with commensurate investments into the Indian equity markets. The thumb rule to remember would be to phase-out our investments by way of an SIP (or STP) in a well-diversified, well-managed equity mutual fund.

If you’d like a more comprehensive guide on equity investing in India, read my book SimplyMutual: The 1% formula to gain financial freedom.

Related Posts

Invest in what you…

Invest in what you…

To quote one of the great investment gurus of all times, Peter Lynch – “People…

Leave a comment

And join the conversation