Are you looking for

financial freedom?

Take control of your life!

Start equity investing with the 1% formula to build wealth and live the life of your dreams.

Know MoreLive the life of your dreams

Retire in your 40s with the 1% formula for financial freedom and get set to follow your passion!

Know More

Gain your Financial Freedom with The 1% formula

Your key to wealth building, financial freedom, and living the life you always wanted - without stress and overwhelm!

The book tackles the idea of wealth building from the very core of your psyche.

It helps you understand your relationship with money and the beliefs and emotions that might be holding you back.

It helps you look at money in a new light, shattering old ideas and making way for new ones that serve you.

It helps you build good investing habits and make informed investment choices.

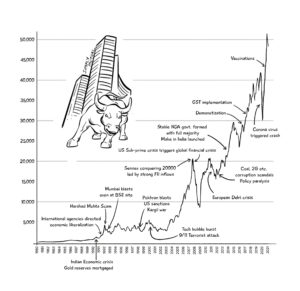

It unravels the complexity of equity investing to make it easier for individual investors to benefit from the India opportunity.

It shows you a straightforward step-by-step approach to build wealth that anyone can use!

With the 1% formula, you can embark on a journey to build a nest egg that takes away your financial anxiety and gives you the freedom to pursue your passion.

If you’ve ever thought of retiring in your 40s to do what you love, this is THE book for you!

I retired at 45. You can too!

Exit the rat race to run a meaningful marathon.

Why do you earn money?

Is it just to add to those numbers in your bank? NO!

The reason you make money is to live the life you desire. Yes, you need money to pay bills and fund emergencies, but there is so much more than that. Money should be able to help you follow your passion, travel the world, to experience life for all it has to offer. But most people are not able to do this. They are held back by their antiquated financial beliefs. Stuck in the vicious cycle of paying bills and EMIs, they never build enough wealth to gain financial freedom.

Don’t let that happen to you!

In my 25+ years as an investment professional, I have discovered the secret to stress-free wealth building. My learnings helped me devise the 1% formula for financial freedom that helped me retire at 45.

And today, I want to share that learning with you! I look forward to your journey to financial freedom.

![]()

It’s truly an individual investor’s guide to equity investing. So much punch packed into this gem! It’ll bust all the financial myths you operate under and give you a no-nonsense approach to handling your money.

Rahul Koul

Founder, Zensciences

![]()

It’s an easy read, something I didn’t expect from a book on equity investing! Loved the storytelling approach and how Deepak explained every concept in a real-life scenario. This is not just gyaan; it’s totally something you can do.

Gaurav Sood

Founder, Sprng Energy

![]()

SimplyMutual has been a wonderfully enlightening read. It has changed my relationship with money. This book has given me a massive confidence boost about investing. It’s super easy to read and understand, even for people who have no background in finance.

Juveria Samrin

Marketer

![]()

I never thought I could read a book on money - let alone understand it, LIKE it, and implement what I learned! SimplyMutual has given me the confidence to invest in equity mutual funds and plan for early retirement!

Adhya

Health blogger at Aura Art of Healthy Living

![]()

You can't find a book that actually makes equity investing sound as easy as SimplyMutual does. I 'm recommending this to everyone I know!

Supriya Jain

Single mom, Entrepreneur, TEDx Speaker

How much do you need to invest to

gain financial freedom?

In the first calculator enter the amount you have available to invest as a lumpsum. Enter the SIP amount you can commit to. Enter the rate of return you expect from the investment and the number of years you can continue this SIP. Then hit calculate. This will tell you the total value of your investment after the specified number of years. This total becomes your lump sum for your next investment stint. Change the SIP amount in the next section and follow the same process.

Salary Pension Corpus Calculator

Stage I

Stage II

Stage III

Total corpus After years:

What is holding you back

from building wealth?

Most likely, it’s the way you think about money.

- Do you save instead of investing?

- Do you go for fixed return investment options?

- Do you save or invest as and when you have the money?

- Do you give in to fear or greed when making investment decisions?

Looking for investment insights?

Sign up for my newsletter.

SimplyMutual © 2023 All Rights Reserved

Past performance is not an indicator of future returns.