Markets are making all time highs nearly every other day and the pace of the rise is creating fears of an impending sharp fall. Our analysis shows that there is much more upside to come and the sharp correction may not happen altogether

The market movements today should be viewed with the perspective of the following series of events: -

The market movements today should be viewed with the perspective of the following series of events: -

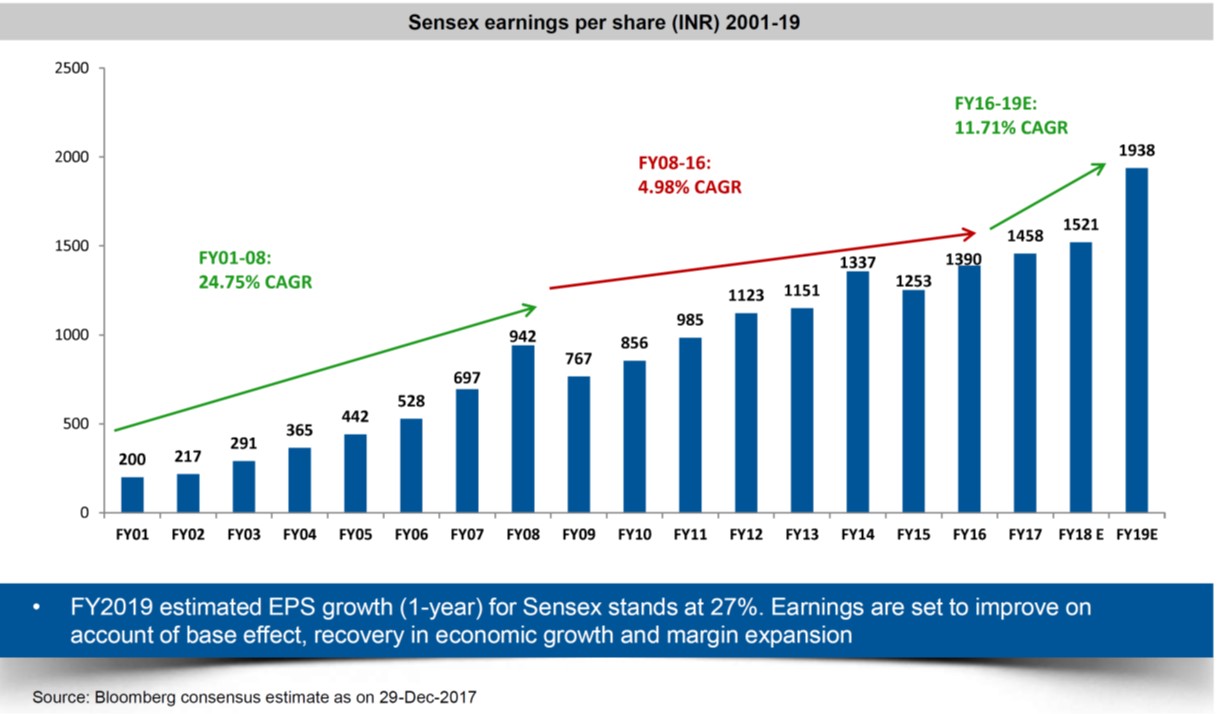

2001-08 – A seven year period of 25% average earnings growth => 2008 – US economic crisis followed by slowdown in all major economies including ours => Further drag in the Indian economy due to policy paralysis phase and scams affecting business environment => Barely 5% Average earnings growth in the period 2008-16

2014 onwards – Newly elected government starts efforts to revive economy and improve sentiment to do business. Large government spending in areas of infrastructure => Significant improvement in sentiment => 2017 Demonetization and GST implementation postpones demand comeback by a year => 2018 – Pickup in demand and earnings. Beginning of a long term double-digit growth phase

Strong positive sentiment has been created in the last few years with good policy decisions and effective attraction of international attention. Now this is coupled with visible directional changes in fundamentals - There is decent pickup in demand across industries with improvement in quarterly results being reported by companies in various sectors

Valuations wise, at Price / Earning (PE) of 18.5 for FY 2019 Estimated earnings and @15.7 FY 2020 estimated earnings are around the long-term average of 17

Lastly, a word of advice for investors who have liquidity to invest in equity - It is practically impossible to time the markets and a correction of 500 points after the markets have risen 4000 points is useless to wait for anyway…

Benefit from our experience. Invest wisely with Simplymutual

2001-08 – A seven year period of 25% average earnings growth => 2008 – US economic crisis followed by slowdown in all major economies including ours => Further drag in the Indian economy due to policy paralysis phase and scams affecting business environment => Barely 5% Average earnings growth in the period 2008-16

2014 onwards – Newly elected government starts efforts to revive economy and improve sentiment to do business. Large government spending in areas of infrastructure => Significant improvement in sentiment => 2017 Demonetization and GST implementation postpones demand comeback by a year => 2018 – Pickup in demand and earnings. Beginning of a long term double-digit growth phase

Strong positive sentiment has been created in the last few years with good policy decisions and effective attraction of international attention. Now this is coupled with visible directional changes in fundamentals - There is decent pickup in demand across industries with improvement in quarterly results being reported by companies in various sectors

Valuations wise, at Price / Earning (PE) of 18.5 for FY 2019 Estimated earnings and @15.7 FY 2020 estimated earnings are around the long-term average of 17

Lastly, a word of advice for investors who have liquidity to invest in equity - It is practically impossible to time the markets and a correction of 500 points after the markets have risen 4000 points is useless to wait for anyway…

Benefit from our experience. Invest wisely with Simplymutual

Related Posts

Invest in what you…

Invest in what you…

To quote one of the great investment gurus of all times, Peter Lynch – “People…

Leave a comment

And join the conversation