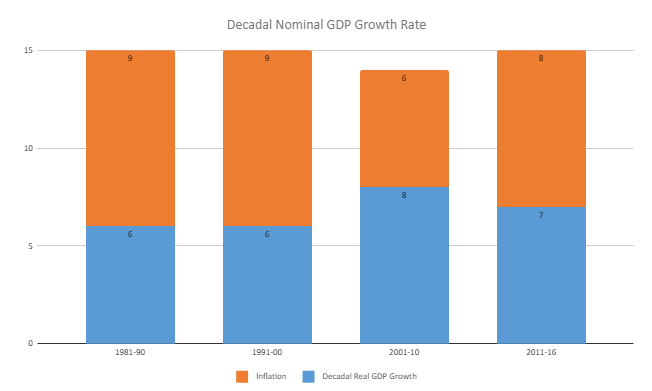

India is a secular growth economy and over the decades, the economy has withstood the test of national and international events, gone through upturns and downturns, with nominal GDP (Manufacturing, Services and Agriculture) growing at near-constant decadal rates of about 15% per annum

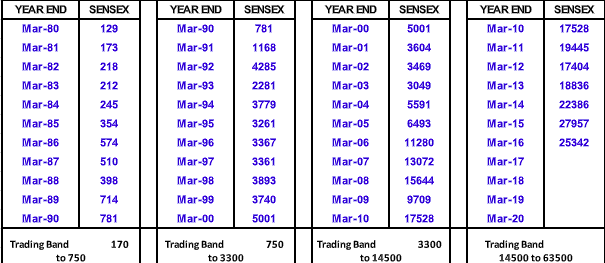

Stock markets have representation from the manufacturing and services sectors but not from agriculture. As these sectors are growing relatively faster than the agriculture sector, the long-term market returns are at 16%+ compounded annually – considering the fact that 1979 was the base year of the Sensex at value 100

At a lucrative 16% returns there is only one thing that keeps investors from investing in stock markets – Volatility. The 16% is not assured to come every year. Historic data shows us that there could be 2-3 years of continuous negative returns before finally getting to a very good year which makes up for all the lost returns. That is the nature of equities – in the short-term simply volatile, but in the long-term the best asset class to invest in

At 16%, share prices rise approximately 4.4 times each decade!

Stock markets have representation from the manufacturing and services sectors but not from agriculture. As these sectors are growing relatively faster than the agriculture sector, the long-term market returns are at 16%+ compounded annually – considering the fact that 1979 was the base year of the Sensex at value 100

At a lucrative 16% returns there is only one thing that keeps investors from investing in stock markets – Volatility. The 16% is not assured to come every year. Historic data shows us that there could be 2-3 years of continuous negative returns before finally getting to a very good year which makes up for all the lost returns. That is the nature of equities – in the short-term simply volatile, but in the long-term the best asset class to invest in

At 16%, share prices rise approximately 4.4 times each decade!

The decadal data shows that give or take a few percentage points, the markets finally do follow mathematics

Then do we need to worry about short-term volatility or just focus on the big picture, the big wealth multiplier – Simply Equity

The decadal data shows that give or take a few percentage points, the markets finally do follow mathematics

Then do we need to worry about short-term volatility or just focus on the big picture, the big wealth multiplier – Simply Equity

Leave a comment

And join the conversation

Leave a Comment

You must be logged in to post a comment.

2 thoughts on “Volatile markets – no problem”

Related Posts

Invest in what you…

Invest in what you…

To quote one of the great investment gurus of all times, Peter Lynch – “People…

Interesting statistics